ONESOURCE Indirect Tax Determination

Streamline taxes with accuracy and compliance

Simplify tax compliance and remove the burden from tax and IT teams with ONESOURCE Determination's powerful features and seamless integrations.

Cloud-native capabilities

Leverage cloud-based technology and automation to simplify indirect tax determination without the risks and expense of managing an in-house tax engine.

Determination Anywhere

Deploy ONESOURCE Determination as close to the origin of tax calculation as possible with edge computing. Maximise calculation speed, minimise latency, and deliver the benefits of a cloud-based tax engine with enhanced control.

Zero-downtime updates

Get the latest tax rates, rules, and security measures automatically applied to your system without downtime. In 2023, we handled over 2.8 million tax rate and product taxability changes for customers.

Auto scaling and self-healing

Ensure optimal performance and reliability by automatically adjusting tax computing resources based on demand and repairing failures without human intervention.

Transaction volume

Minimise latency and improve output by taking advantage of ONESOURCE Determination's ability to calculate correct tax amounts for 10 million transactions per hour with response times of 40 milliseconds per transaction.

Advanced tax tools

Our advanced tax tools boost reporting capabilities, streamline certificate management, and provide reliable insights to guide your business forward.

Model scenario

Obtain accurate forecasts for your business by creating transaction scenarios to test configurations and model the impact of business and tax changes.

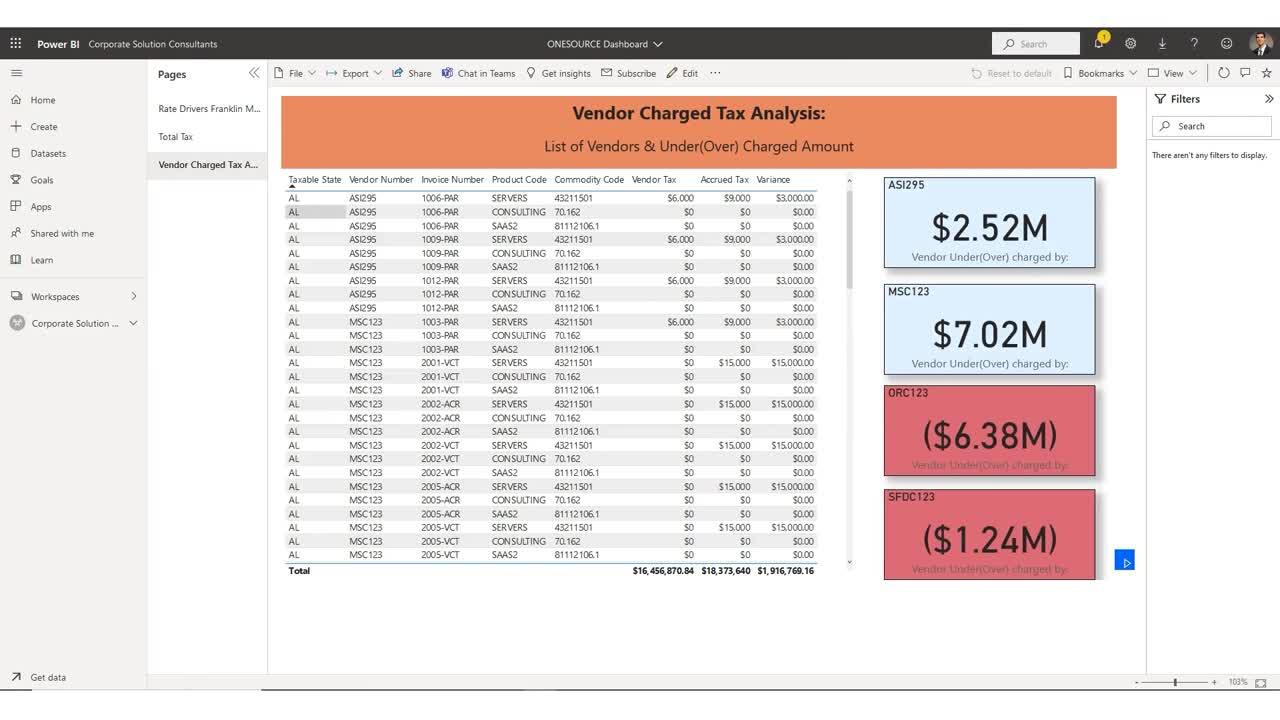

Reporting and analytics

Gain efficiency and confidence with fast and flexible reporting for compliance, reconciliation, audit defense, and data analysis. Containing a library of summary and detail-level, production-ready reports, you can choose the type of data that best meets your immediate reporting needs and create custom reports.

Transaction editors

Achieve the desired tax result by resolving potential transaction issues without requiring users to modify data in source systems.

Address validation

Accomplish more accurate tax calculation by quickly cleansing, verifying, and storing addresses with USPS CASS-certified address validation.

Generative AI product support

Rely on the real-time, chat-based support of ONESOURCE with CoCounsel for quick and accurate answers to your product questions, ensuring efficient and reliable help whenever you need it.

Talk to an expert

Take the first step towards streamlined and automated tax calculations.

Integrations and partnerships

Decrease deployment costs, customisations, and ongoing maintenance with the help of pre-built integrations that minimise interference with your business systems.

Pre-built integrations for 60+ financial systems

Automate your indirect tax workflow with a selection of ready-to-use integrations that seamlessly connect enterprise resource planning (ERP), point-of-sale (POS), e-commerce systems, or other systems with ONESOURCE Determination.

ONESOURCE Determination integrations for SAP

Reduce implementation and ongoing maintenance costs using pre-built, certified, and endorsed applications for SAP ERP, SAP S/4HANA, SAP Ariba, and more.

ONESOURCE Determination integrations for Oracle

Host ONESOURCE Determination within the Oracle Cloud infrastructure or connect your systems with any of the premade integrations including Oracle ERP Cloud and others.

Microsoft Dynamics 365 for finance and operations

This powerful integration enables companies to extend the functionality of their ERP software to handle every step of the sales and use tax process, delivering SaaS capabilities along with robust features.

Superior tax content

This solution covers rates, product and service taxability, and calculation logic for more than 205 countries and territories, encompassing over 460,000 product and service codes across more than 60,000 global tax jurisdictions.

Automatic updates

The Thomson Reuters "no downtime updates" ensure that connected systems are always using the latest rules and rates without having to interrupt any tax calculations.

Global reach

Supporting over 205 countries and territories across all industry types, ONESOURCE Determination enables businesses to manage tax consistently from one tax calculation engine.

Certified content

In 2023, we made over 2.8 million changes to the content that powers ONESOURCE Determination, offering a low-maintenance solution for both tax and IT departments. ONESOURCE is SOC 1 and SOC 2 certified annually.

Frequently asked questions

Common errors in tax determination include incorrectly applying tax rates, failing to account for available exemptions or deductions, misclassifying of goods or services, and data entry errors. To minimise these errors, businesses can implement robust tax software that stays up to date with the latest tax laws and rates. Conducting regular audits to catch discrepancies early and providing comprehensive training for staff on tax policies and accurate record-keeping. Engaging with tax professionals for advice and verification can also help ensure compliance and accuracy.

Changes in businesses operations, like expanding to a new market or altering new product offering, can impact tax obligations by introducing new compliance requirements. It is important to regularly review tax implications of operational changes and consult with professionals to ensure continued compliance and optimise your tax position.

To optimise tax determination and take full advantage of available benefits, businesses should stay informed about all eligible deductions and credits. Engaging in strategic tax planning, such as timing income and expenses, can help minimise tax liabilities. Consider adopting tax-efficient business structures and retirement plans, and work closely with tax advisors to identify specific opportunities for tax savings that align with your industry and business activities.

Yes, automate processes using tax software that applies correct rates and integrates with accounting systems. This reduces errors and saves time, allowing your business to adapt quickly to tax law changes and focus resources elsewhere.

Experience it for yourself

Take the first step towards streamlined and automated tax calculations.

Have questions? Contact a representative